Michigan Financial Planning for Retirement and Beyond

We are a Michigan Financial Planning Company that works exclusively with retirees and those of you who are nearing that phase of life. We don’t work with anyone else. Perspective clients have a minimum of $500,000 of investable assets.

What we do is plain and simple

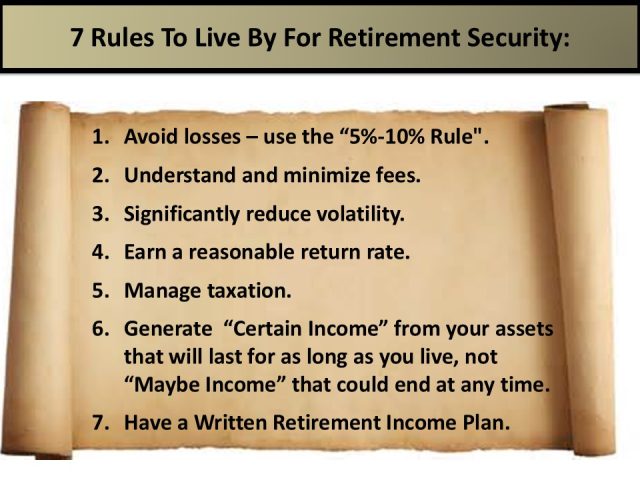

Whether it is over the phone, via the internet, or in person, if you are retired or nearing retirement, you’ve got to:

- Reduce your risk.

- Cut your fees.

- Maximize income.

- Guarantee your income is going to last as long as you live.

- Have that entire plan in writing.

Why You Are Here

You are probably currently handling your finances in one of two ways:

- You are doing everything yourself and recognize you need some help handling some or all of your money.

- You have another advisor you like who created a great deal of wealth for you over the years you were working, but are concerned that advisor is not the right advisor for the rest of your life, during your non-working years.

And you are probably tired of hearing things like:

- “Don’t worry, ride it out; the market will come back.”

- “We will just keep investing the same way we always have, and take money out as you need it.”

- “You must be in the market to have a successful retirement.”

Changing Uncertainty into Certainty

You may be wondering if you can and should retire now. Our Income For Life software is designed to show you a way to retire sooner and stay retired. You can make an informed decision based on math, science, and facts, not opinions, estimates, and guesswork. You should never make an important once-in-a-lifetime decision based on maybes and pie-in-the-sky projections.

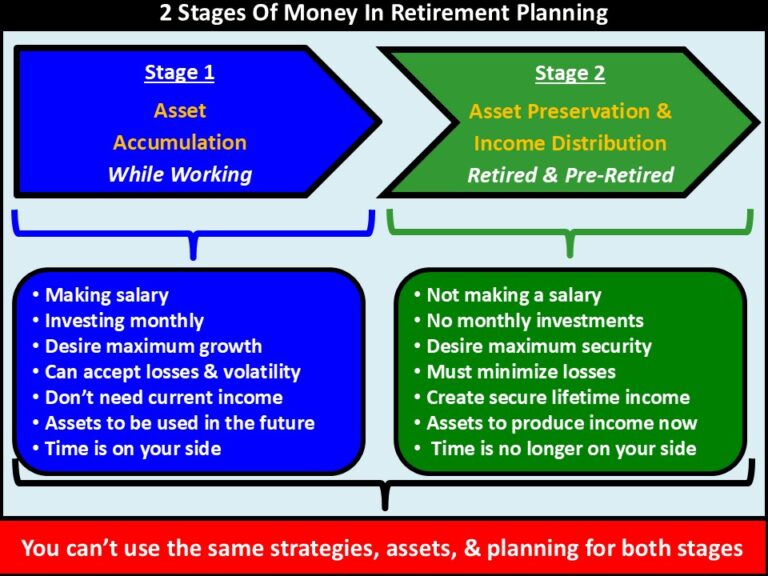

Objective Advice for Both Stages of Life

Accumulation Phase

It’s about assets, not income. While you are working you want to accumulate as much wealth as you can.

Distribution Phase

It’s about income, not assets. When you are retired and not working, you should have a lifetime of income and not run out.

Anywhere and Anytime

As a Michigan financial advisor, we provide our clients independent objective advice to retirement and beyond. We can meet you anywhere you have access to an internet connection or by phone. Wherever you’re comfortable, at home, at work, on vacation or even in person, we make it easy for you to get the strategies and coaching you deserve!

Does This Sound Familiar?

Your current Michigan financial advisor:

- Has created a great deal of wealth for you over the years.

- Provided some financial planning.

- Gives you a couple of meetings a year.

- Has an occasional phone conversation with you.

But what you want is:

- Specific financial advice about everything you need to do in order to achieve all your financial goals.

- To know whether you are on track or off track and what you should do to get on track or stay on track if you are not on track.

- Your family to be fully prepared for everything that could impact their money.

- Answers to questions in simple and easy-to-understand terms.

- A written retirement income plan.

It's your lifestyle

Our clients are financial delegators who let us handle all of their financial “stuff.” You have better things to do than worry about what’s happening on Wall Street. They are comfortable with our way of doing business and how we are compensated.

Your financial objectives are unique

Your decades-long journey to a well-funded retirement through wealth accumulation requires you to hopefully head steadily down the road to financial success, even when the pavement has potholes. Therefore, we help our clients:

- Focus on their time horizon.

- Follow facts, not emotions.

- Gradually make adjustments.

This is the time in your life that it’s not so much about what you earn, but about what you get to keep. Ultimately, in retirement, it’s not what you make; it’s what you get to spend.

Your financial objectives are unique.

Spending money is what you do in retirement. The trick is not to overspend early on and run out of money later in life when you need it the most. Would you board a plane that has a ninety percent (90%) chance of making it to its destination? Of course not. But you probably want to board retirement with a one hundred percent (100%) chance of landing safely at your journey’s end.

Your Michigan Financial Advisor Needs New Skills

The skills and strategies used to accumulate money are very different from those utilized when planning to spend it in retirement. The earlier in life you plan for your retirement lifestyle, the better off you can find yourself in retirement.

To Meet New Challenges

Retirement presents new challenges for you to navigate like:

- When to take Social Security.

- Medicare and rising health costs.

- Inflation.

- The sequence of return risk.

- Having enough income to see you through it.

What retirement is really about

The success of your retirement is not about assets or how big your 401(k) is. You may have been told the bigger the pile of money, the better your retirement will be. In retirement, it’s no longer about how much you saved, it’s about taking your life savings and:

- Converting part of it into an inflation-protected spending plan to support your retirement lifestyle.

- Adapt the balance into a professionally managed retirement plan.

It’s the proper management of income and wealth that makes for a fulfilling retirement

Here at the Wealth & Income Management Group, we focus on helping in helping our clients retire successfully and want to work with you for the long term. We’re looking for clients who are a good fit, and we can help them live their dream retirement. In addition, we do not offer a one-size-fits-all, cookie-cutter approach.

How we are compensated

We have found that in order to be a good fiduciary, we need to offer both fee-based and commission-based products when appropriate to complete your retirement plan. We do not try to force a square peg into a round hole like many of our competitors do. After you understand your choices, it will be up to you to decide which is appropriate. We believe that an advisor who offers one without the other is only doing half the job. Above all, we see our job as presenting you with products, solutions, and ideas you might not have thought of on your own.

What’s keeping you up at night?

You should not be losing sleep worrying about things like:

- Stock market volatility and outside economic problems affecting your retirement

- Rising inflation, taxes, and future healthcare costs

- The current performance of your portfolio

- The growing federal deficit

In Conclusion

Albert Einstein’s definition of insanity is doing the same thing over and over yet expecting different results. You can keep doing the same thing, keep risking, keep worrying, and/or keep going without. Or you can get a second opinion, to explore ways you might protect your money, increase income, and reduce fees, then feel secure and enjoy life.

We will meet with you one-on-one, find out where you are at, meet with you as many times as needed, ask you what you want to happen, and not charge you any fees to meet. We will design an actual written plan for you, with strategies intended to help manage risk and protect against significant losses, create a dependable lifetime income plan, earn competitive returns, help you understand your money, create your financial freedom, and help you stop worrying about your money. It is all about what is important to you.

So here are your Next Steps

If we haven’t already met, please schedule a time using the on-line calendar for an introductory phone call or send us an e-mail. We will treat you politely and like a professional, with no pressure. We don’t like to be pressured to buy anything, and neither should you. What we do after the initial call is up to you. It is important to get the facts before you make any long-term decision.

What we would like to help you with

Replace Your Paycheck

It’s not about the size of your pile of money. It’s about having a paycheck and a playcheck forever. Know that you will always have income, don’t hope for it.

Get Your Plan in Writing

A financial promise, projection, or plan that is verbal and not in writing is just a bunch of hot air. You need a written plan for a successful retirement.

Feel Great About Your Future

Live the worry-free and stress-free lifestyle you dreamed you would have in retirement, regardless of what’s happening on Wall Street.